If you look at where $250,000 in household income buys you the most house, all of the top ten cities are in the South. The purchasing power of a $250,000 salary, for instance, depends largely on a city’s cost of living and overall tax environment. High earners might be able to maximize their earnings and […]

The share of baby boomers has surpassed millennials and now makes up the largest generation of home buyers, according to the latest study from the National Association of Realtors®. The 2023 Home Buyers and Sellers Generational Trends report, which examines the similarities and differences of recent home buyers and sellers across generations, found that the […]

For the first time since records began, first-time homebuyers made up the smallest share of sales last year at 26% Despite a recent softening in the US housing market, a combination of rising borrowing costs and still-high prices have put prospective first-time homebuyers in a serious bind. The difficulties for first-time buyers have been escalating […]

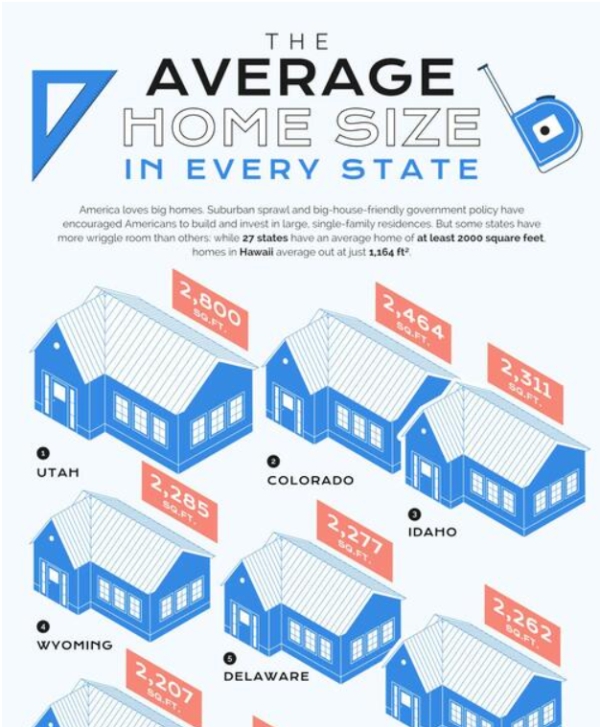

Over the last century, the average home size in the U.S. has skyrocketed. In 1949, the typical single-family home was just 909 square feet—by 2021, it had shot up to 2,480 square feet. According to The 2022 American Home Size Index the shift towards larger homes was exacerbated by the COVID-19 pandemic when concerns over […]

Nearly 30 percent of Americans born in the late 1990s and early 2000s still live at home with their parents or relatives, according to a new survey conducted by Qualtrics. The survey also found that 28 percent of respondents are not able to save right now. Another 27 percent said they live with a romantic […]

According to the National Association of Realtors® recent Existing Home Sales report, the median existing-home price for all housing types in February was $357,300, up 15.0% from February 2021 ($310,600), as prices grew in each region. This marks 120 consecutive months of year-over-year increases, the longest-running streak on record. Properties typically remained on the market […]

On Friday, March 11th, the Federal Reserve placed their last remaining order to purchase Mortgage Backed Securities (MBS) as part of their emergency Quantitative Easing program. This was a program where the Federal Reserve Bank of New York would purchase both U.S. Treasuries notes and MBS bonds. They did this to create an increase demand […]